Comparing the Independent Accountability Mechanism Policy Review Process Across MDBs

Note: This article has been updated on 11 April 2024 to reflect a change in AIIB’s PPM Policy review process.

2024 is a big year for Independent Accountability Mechanism (IAMs) with at least four IAMs undergoing official reviews of their policies and practices. These include IAMs associated with the World Bank, the Asian Development Bank, the European Bank for Reconstruction and Development, and the Asian Infrastructure Investment Bank. Combined, these banks have invested billions of dollars in development projects, and there have been at least 456 IAM complaints alleging environmental and social grievances relating to their investments. These reviews also come at a time when multilateral development banks (MDBs) have been entrusted with greater mandates to combat the urgent climate crisis. It is imperative that the IAM policy reviews result in strong improvements to protect and guarantee the rights of project-affected communities around the world.

In this article, we compare these four banks’ proposed review processes and–when information is available–benchmark them against good practice to identify strengths and missed opportunities.

Why A Good Process Matters

As we have written before, MDBs are publicly-funded institutions that invest in development projects that aim to improve the lives of the most marginalized communities. When investments lead to environmental and human rights harms, MDBs are accountable to communities through their IAMs, which can investigate non-compliance with environmental standards or facilitate a dispute resolution process. As public institutions, impacted communities should be able to shape the process through which MDBs are held accountable and should have a say in the design of the IAM. An open and public process increases both the legitimacy of the review and the trust affected communities have in the mechanism.

Not only is a transparent and inclusive review process principally important, but it also results in better outcomes. We know from past experience that powerful interests can oppose strong and effective accountability mechanisms and that hearing from and designing mechanisms for project-affected communities serve as safeguards against regression.

What a Good Practice Looks Like?

An IAM review process must be independent, transparent, and inclusive of the views of project-impacted communities. This requires more than simply seeking comments on draft procedures, which are often heavily negotiated internally before they undergo public scrutiny. Instead, MDBs must be guided by project-affected community experiences even as they start the review process and be open to changing course based on community expertise. Moreover, these principles must be complied with in letter and spirit and not just as a check-box exercise. For example, it is not rare for Banks to commit to broad and inclusive consultations with civil society organizations and yet not have many or most of their recommendations reflected in the final draft of the policy. One way of safeguarding against that is responding to the list of recommendations received and including reasons for why recommendations were not accepted.

Comparing the Review Processes of the Asian Development Bank and the Asian Infrastructure Investment Bank

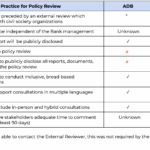

The IAMs associated with the ADB and AIIB have already announced their plans for a formal review and the following table compares the IAM policy review processes of the ADB and AIIB on considerations of independence, inclusiveness, and transparency. Given the gaps highlighted below, we urge the ADB to publicly commit to ensuring that: (i) bank management will not substantively amend the report of the external reviewer before it is publicly disclosed; (ii) all documents that inform the policy review will be publicly disclosed; and (iii) ADB’s Accountability Mechanism staff will lead the policy review. We further call upon both ADB and AIIB to commit to a 90-day consultation period once the revised policy is released.

In addition to the AIIB and ADB, the IAMs associated with WB and EBRD are also undergoing reviews this year. Both processes include an external review of the IAMs current policy and practices. So far, the external reviews of the mechanisms include consultations with civil society organizations, are being conducted with some independence from bank management, and require public disclosure of the external review report. To date, the plans for the rest of the review processes have not been publicized. We call upon the banks to publish their formal policy review processes and ensure that they continue to meet best practice.

Conclusion

An IAM policy review affords an MDB the opportunity to reflect on its past record and consider how it can better ensure remedy for project-affected communities and prevent and mitigate future harm. All of the MDBs undertaking reviews have IAM policies that fall short of international good practice and it would be a missed opportunity for these reviews not to lead to substantive improvements. Good processes are more likely to lead to good outcomes, and we call on the MDBs to ensure their policy reviews are aligned with the principles of transparency, independence, and inclusiveness.

Find this article featured in NGO Forum on ADB’s March 2024 Bankwatch publication here.

Related Posts

- 31 May 2023 Safeguarding ADB’s Accountability Mechanism Policy Review

- 26 September 2023 World’s newest multilateral development bank lagging on accountability

- 27 February 2024 World Bank Response to Sex Abuse Scandal is a Test of its Credibility

- 25 January 2024 EBRD under pressure over human rights complaints